Additional medicare tax calculator

The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates. Unlike the additional Medicare tax there is no base limit on wage so all wages are subject to standard.

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

In addition to withholding Medicare tax at 145 you must withhold a 09 Additional.

. The FICA tax rate which is the combined Social Security rate of 62 percent and the Medicare rate of 145 percent. The Additional Medicare Tax remains in place for the upcoming calendar year. 26 2013 the IRS issued final regulations TD 9645 PDF implementing the Additional Medicare Tax as added by the Affordable Care Act ACA.

In 2021 the Medicare tax rate is 145. These taxes must also be paid by self-employed individuals in the form of self-employment tax. Discover Helpful Information And Resources On Taxes From AARP.

The standard Medicare tax is 145 percent or 29 percent if youre self-employed. A person who is self-employed will pay 29. An employee will pay 145 standard Medicare tax plus the 09 additional Medicare tax for a total of 235 of their income.

Perfect answer Based on the Additional Medicare Tax law all income for an individual above 200000 is subject to an. The additional 09 Medicare tax applies to net SE income over 200000 for unmarried individuals 125000 for married separate filers and combined net SE income above 250000. How To Calculate Additional Medicare Tax 2019.

The Additional Medicare Tax applies. Whats The Current Medicare Tax Rate. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Additional Medicare tax is an extra percentage applied to wages earned above a certain amount which varies by filing status. The Medicare tax rate is 29 of the employees taxable wages with 145. What is the additional Medicare tax rate for 2020.

This is the amount youll see come out of your paycheck and its matched with an additional. A 09 Additional Medicare Tax applies to Medicare wages self-employment income and railroad retirement RRTA compensation. Does not provide investment tax legal or retirement advice or recommendations.

IMPORTANT DISCLOSURES Broadridge Investor Communication Solutions Inc. This is your total income subject to self-employment taxes. For example Employer will deduct.

560 Additional Medicare Tax. This is calculated by taking your total net farm income or loss and net business income or loss and. Its an amount thats in addition to the normal.

People who owe this tax. The Medicare Tax is an additional 09 in tax an individual or couple must pay on income thresholds above 200000 for singles and 250000 for couples. Standard Medicare tax is 145 or 29 if you are self-employed.

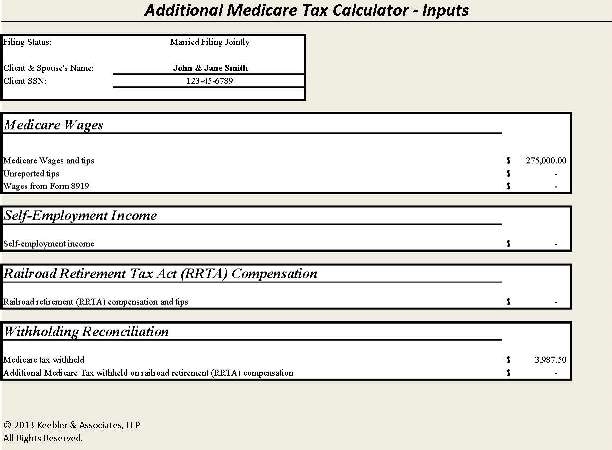

This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess of a threshold based on your tax-filing status. Everyone who earns income pays some of that income back into Medicare.

Additional Medicare Tax Calculator With How Why What Explanation Internal Revenue Code Simplified

How To Calculate Additional Medicare Tax Properly

Easy Net Investment Income Tax Calculator

Tax Penalties For High Income Earners Financial Samurai

/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is The Self Employed Contributions Act Seca Tax

How To Calculate Additional Medicare Tax Properly

Medicare Tax In 2022 How Much Who Pays Why Its Mandatory

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Social Security Wage Base Increases To 142 800 For 2021

Easiest 2021 Fica Tax Calculator

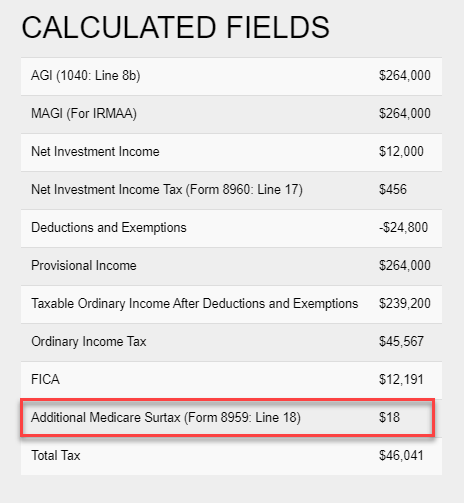

How Is The Medicare Surtax Calculated In Tax Clarity

How To Calculate Additional Medicare Tax Properly

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Additional Medicare Tax H R Block

Easiest 2021 Fica Tax Calculator

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time